Another banking crisis is unlikely. We get inflation instead.

Commodity futures are far and away the most effective hedge against inflation. It's time to learn how to navigate...

I don't believe we’ll have another major banking crisis. In june of 2007, two Bear Stearns hedge funds had large margin calls (over $400 million), which they were unable to meet. The fallout from that event was limited, and we had plenty of assurances that this was a small hiccup, nothing to worry about, the system was sound, etc. But the system was not sound at all - it was, and still is very fragile and crisis-prone. For example, between 1992 and 2002, more than 65 major financial crises erupted around the world.

This time, it’s different

The big one - the Global Financial Crisis of 2008 - happened eight months after the Bear Stearns crisis with the “sudden” failure of Lehman Brothers. But I do not believe that failures of the Silicon Valley Bank and Signature Bank will trigger a cascading avalanche as the Bear Stearns hedge funds triggered 14 years ago. This time, it's different. Recall, back in 2008 the Fed was not able to bail out the banking system without Congressional approval. Treasury Secretary Hank Paulson had to beg for a $700 billion bailout of "too big to fail" banks literally on his knees. But such prostration is no longer necessary: today the Fed has full discretion to bail out banking institutions as needed. And the need is far greater than it was in 2008:

The system is well and truly broken; US banks have accumulated massive losses on their bond investments, and without a bailout they might be forced to sell assets on their books. That would precipitate a crisis much worse than what we experienced in 2008. This is that "seed of doom," which is baked into the fractional reserve banking equation from the get go: the bank failures are only a matter of time.

But in a world where central banks have the facility to "print" infinite amounts of currency to backstop the losses of the corporate and banking system, failed banks can continue to operate, undead for years and perhaps decades. The current crisis will probably used to consolidate the industry and we might see many small regional banks fail or be absorbed as the monopolists gobble up competition, but a failure of the system will not be allowed.

We’re in socialism now, baby

So, if the central banks opt to keep the system afloat – bad debts, losses and all – what we inevitably get is inflation and a gradual collapse of the currency. In a capitalistic free market system, this should not happen: failing banks failed and in a free market, bank runs were a periodic occurrence. But we are no longer operating in that system: a silent banking coup has taken place and it ushered socialism, though only for the too big to fail banks and large corporations. For everyone else, it’s still the rugged, cut-throat capitalism.

I grew up in Socialism and much of what I observe today reminds me of my youth. In the former Yugoslavia, we had a bad crisis of stagflation throughout the 1970s and 1980s, but never a banking crisis. I was too young to question how the system worked back then, but it was clear that the central bank was providing all the liquidity needed to keep the system afloat and keep workers employed. But the price was paid by everyone collectively through inflation which gradually accelerated until the currency became entirely worthless.

The Fed will print…

I believe that the Federal Reserve will tread the same path. The benefit of choosing that path is that the crisis will unfold gradually. The alternative, allowing the large banks to fail and corporations to go bankrupt, would precipitate a rapid collapse with mass unemployment and disruptions that could unleash social uprisings with a fallout that could be extremely difficult to control.

So the choice for central bankers throughout the developed world is either to allow free markets to operate, or to embrace socialism. It’s a choice between a sudden-onset collapse and an unmanageable crisis, or “printing” all the currency needed to paper over the gaping financial holes in the system and having a amore gradual and more manageable unravelling. I think no central bank in the world will opt for the free market capitalism at this point.

Inflation will flare up again

The consequence of that choice will be that the crisis of inflation will continue, inflicting very substantial losses on investors. According to Stanley Fsicher‘s “Modern Hyper- and High Inflations,” since 1960, more than two thirds of the world’s market economies experienced episodes of inflation of 25% or higher. On average, investors lost 53% of their purchasing power during such episodes. In many cases, the losses were much worse. During the 1970s inflation, US investors lost as much as 65% in real terms.

In some episodes, like the Weimar Republic 100 years ago, the losses came close to 100%. So what to do? For sure, investors should take bold action to protect their portfolios, and there aren’t very many good alternatives.

How to hedge against inflation?

Contrary to popular opinions, stocks on the whole are not a good inflation hedge. Gold and Silver will eventually shine through and should certainly be considered. Farmland is another viable option. Prior to 2021 I would have suggested Bitcoin as well, but it is not a riskless panacea and I think it should only be regarded as one of the assets to include in a broadly diversified portfolio. However, there is one asset class that trumps all others when it comes to inflation hedging…

The best hedge: commodity futures

As a currency’s purchasing power declines, the prices of real stuff that people use in their daily lives will rise, particularly energy, metals and agricultural commodities. This common sense idea is also supported by much empirical evidence.

For example, in the paper titled, “Assessing Managed Futures as an Inflation Hedge Within a Multi-Asset Framework,” published in the Journal of Wealth Management (April 2011), the authors concluded that, “Managed futures outperform the other asset classes… No other asset class presents itself as a viable inflation hedge.”

Their finding corroborated an earlier Alliance Bernstein’s research which found that “managed futures” (i.e. exposure to commodity futures prices) had the highest inflation beta of all asset classes:

Well, the current crisis of inflation gave us another confirmation for this: as inflationary pressures gradually built up, Goldman Sachs Commodity Index skyrocketed more than 3.5-fold, from 231 in April 2020 to 830 in June 2022. Recent research from Deutsche Bank’s Jim Reid showed that this commodities cycle has so far been the strongest on record, eclipsing all of the previous 20 cycles since 1914 , as the following chart shows:

Commodity futures double up as a portfolio diversifier

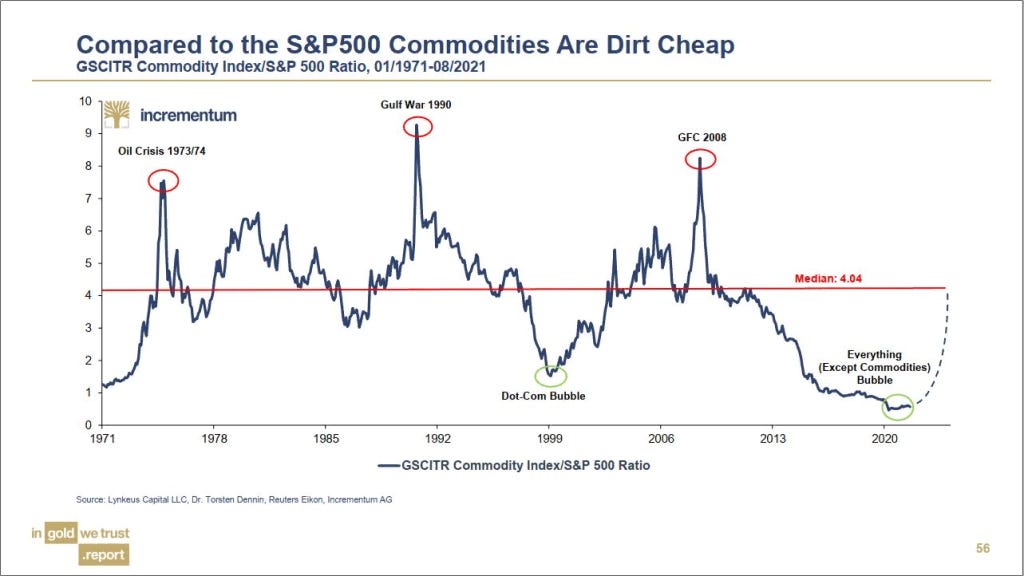

Commodity futures provide investors with another benefit: they are the ideal portfolio diversifier. If stocks and bonds prices collapse, they’ll take most of the asset classes with them and there will be few escape routes for investors. While commodities could experience sharp corrections in the short term, their down-side is probably very shallow relative to the up-side we could see over the longer term. The chart below shows the historical relationship between commodity prices and equities, and we are still close to the historical all-time lows:

A mere reversion toward “normal” valuation levels may present an attractive investment opportunity in its own right as well as a real means of diversification just when this is most urgently needed. Adding exposure to commodities like energy, metals and key agricultural commodities should be among the most compelling investment alternatives for the decade of 2020s.

Markets move in trends

A word of warning is in order: it won’t do to simply purchase a commodities ETF and ride the cycle passively may not be the best approach. Commodity prices can be volatile and they tend to be quite sensitive to liquidity conditions on the market. I believe that the best, and perhaps the only sustainable solution to uncertainty of market price fluctuation is trend following, and preferably systematic trend following.

Trend following offers investors a number of important advantages, the first of which is truth. Namely, trend following is based on the only source of market information that is true, unambiguous and timely: the price of securities itself. Trend followers can ignore all other information which insulates their decision making from biased reporting, flawed data, erroneous analyses and lies.

Second, trend following entirely absolves us of the need to be right about the future of markets. The strategy will keep you long through up trends, short during down-trends and it will “change its mind,” when market events warrant it, unburdened by beliefs and convictions that could prove mistaken.

Third, trend following can greatly enhance investors’ versatility and diversification. Because the strategy is only concerned with analyzing security price fluctuations, it can be applied in any market. You can just as easily trade stocks, bonds, currencies or commodities, even if you know little or nothing about those markets. If you think that I exaggerate, I’ll confess that during my career I’ve traded in more than 50 different financial and commodity futures markets and I know next to nothing about most of them. In spite of that I was able to consistently outperform my strategy benchmarks for 13 years straight.

The versatility of systematic trend following could be particularly important in today’s market conditions. The ability to diversify from the overinflated traditional asset classes and diversify into commodities like crude oil, copper or silver, or even agricultural commodities like wheat, corn, cotton and coffee could prove decisive.

Free resources

My book “Mastering Uncertainty in Commodities Trading," was rated #1 book on FinancialExpert.co.uk list of “The 5 Best Commodities Books for Investors and Traders” for 2021.

The “Trend Following Bible,” which covers much of the same curriculum is more up to date (it was published in 2021) and to my mind a better book. Both are available free of charge at the above links.

I-System TrendCompass

In addition to providing superbly engineered turn-key portfolio solutions for investment advisors and HNWIs, at I-System Trend Following we publish the daily I-System TrendCompass report, one of the best trend following newsletters on the market, delivering reliable, versatile and effective daily decision support for investors and traders. One month test-drive is always on us. Sign up for a 1-month FREE trial by e-mailing us at TrendCompass@ISystem-TF.com

For US investors, we can propose a full service investment solution (to learn more, please click here).

Is there an updated (including 2022) commodity / S&P chart? 2022 had some large commodity moves

I finished your first book . It was / is great. I have downloaded your second. Thank you for making both available.