Investing: how not to lose

We're in a new game, requiring new thinking, versatility and resilience.

Navigating the markets has become increasingly difficult and rife with risk. We should recognize however, that even in the best of times, investors have a strong tendency to underperform market benchmarks. Over a 20-year period from 1988 through 2007, the S&P 500 returned 11.81% annually. During the same interval, the average investor lagged far behind with only 4.48% (N. Scott Pritchard, Journal of Pension Benefits, 2008).

That’s a staggering underperformance. In his commentary to Benjamin Graham’s “Intelligent Investor,” Jason Zweig suggested that investors achieve such poor results “simply by buying high and selling low.” One blogger illustrated it succinctly enough:

Pros do the same

Professional investors - the types that probably manage your pension plans - are equally susceptible to this pitfall. In his 2010 report “Untangling Skill and Luck,” Legg Mason’s Michael Mauboussin cited a study by finance professors Amit Goyal and Simil Wahal, who studied how well 3,400 plan sponsors (retirement plans, endowments, foundations) performed at hiring and firing investment managers over a 10-year period.

They found that pension plan sponsors hired investment managers after they had generated superior returns, only to see post-hiring returns revert to zero. They fired the managers for a variety of reasons (poor performance topped the list), only to see the managers they fired deliver statistically significant excess returns. That’s exactly the same error that the above image illustrates. The key reason for this is that they tend to make their investment decisions when the assets/funds do well and pull the money out when they fall behind.

It’s about the strategy, not the stats

At peak performance, an asset will looks attractive and its performance statistics may appear stellar. But even a temporary decline in performance will make those statistics look much less attractive. When we consider investment funds or pension plans, statistics can’t convey the most relevant attributes of an investment: its quality. Is it based on a valid strategy? Is the investment process credible, well thought-out, and robust? Is the risk management properly calibrated? As Mauboussin concluded:

“in evaluating an analyst or portfolio manager, it is much less important to see how she has done recently than it is to assess the process by which she did her job… And make no mistake about it: the reason to emphasize process is that a good process provides the best chance for agreeable long-term outcomes.”

Inevitably, investing comes with periodic rough patches. In such conditions, the "keep calm and carry on," could be the best approach, so long as the strategy remains valid. But what strategies make sense for the uncertain times that lie ahead?

Which strategies for the future?

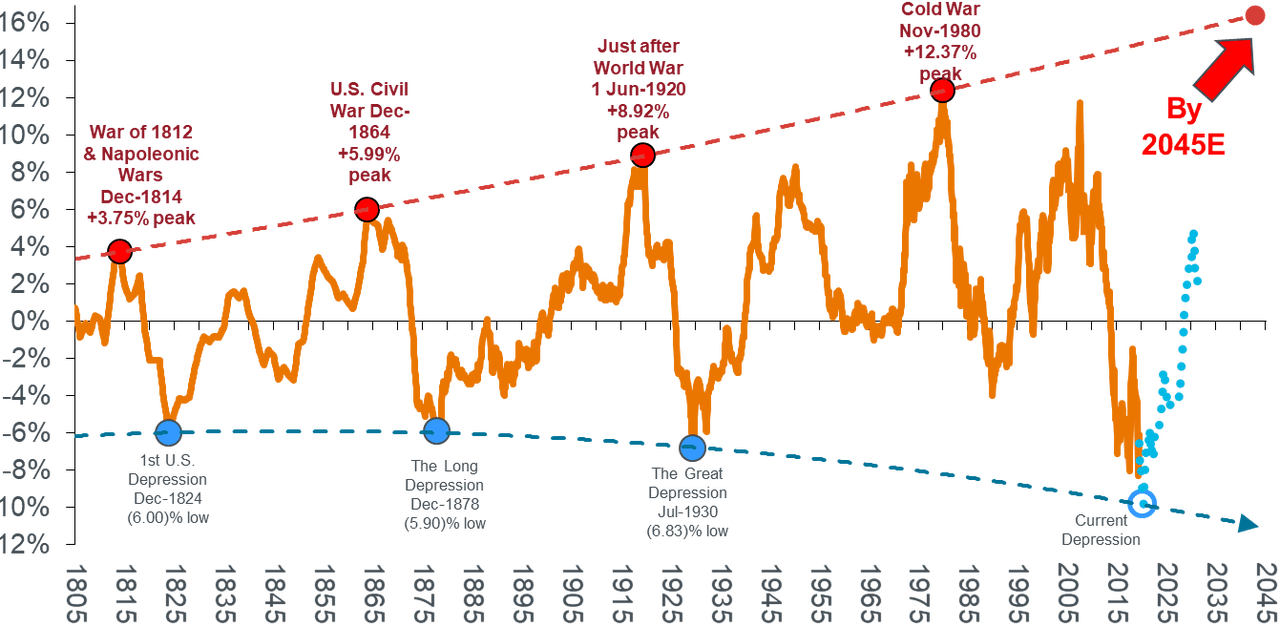

The last 30+ years were defined by globalization, monetary inflation (credit expansion), commodity price suppression and a continued decline in interest rates, as the following chart illustrates:

This trend shaped the conditions that constituted our normal. Most of what we think we know about the economy, capital markets, valuation metrics and risk, we learned in that normal. But those conditions are now gradually dissipating and different trends will shape the next normal. The three key trends we should prepare for include:

A continued rise in interest rates

Stagflation

A commodity super-cycle that could span the coming two decades or so.

Furthermore, the unfolding geopolitical changes could overturn the the centuries-old primacy of the West in global trade, which will drive economic changes in ways that would be impossible to predict. The future is indeed shrouded in uncertainty, so how should investors prepare to navigate the coming changes?

The good news: markets move in trends

Some 2,500 years ago Sun Tzu wrote in “The Art of War,” that there are three avenues of opportunity: events, trends and conditions. As we saw in the above chart, the 30-year decline in interest rates did in fact unfold as a trend. Future changes will almost certainly unfold in trends, and therein lie the good news.

With more than a century’s worth of empirical evidence, trends have proven to be far and away the most powerful drivers of investment performance, and trend following strategies have proven effective in capturing investment profits from trends. I have summarized these twin hypotheses in two earlier articles you can find at the following links:

Why trends are the most powerful drivers of investment performance

Why trend following is the only valid answer to the problem of uncertainty

Crossing the mindset barrier

Trend following has enabled many investors to outperform market benchmarks for more than 50 years. Yet, in spite of its undeniable success, most investors either don’t know enough about it, or continue to regard the strategy as an oddity, not entirely fit for the ranks of serious market professionals - you know, the same folks that habitually underperform. But the reason for this rejection of trend following has nothing to do with performance. It is largely cultural.

Namely, most of today’s market experts were educated in the Cartesian tradition which validates rigorous scientific method as a way to acquire knowledge. Value is placed on understanding linear cause-and-effect relationships that allow us to make predictions about stuff. This mindset has an obvious appeal in investment speculation: we expect to profit from market events by understanding and predicting how the conditions we can observe would cause those events. That same mindset also gives us the comforting sense of competence and control.

Trend following is a cultural misfit in this intellectual tradition. To begin with, it is based on a field of study called technical analysis where knowledge accrues through judgment heuristics and experience rather than empirical science. Trend following also blurs the relationship between intellectual work and its expected results. The linear thinking investor judges a transaction according to an explicit understanding of how and why that transaction should generate a profit.

By contrast, a trend follower simply implements a strategy, a set of predefined rules, accepting that any given transaction may produce a loss. He expects profits, not from any particular transaction, but from the process that spans long sequence of trades extending indefinitely into the future.

Thus, while the conventional approaches to investing stem from an understanding of a particular situation, trend following is based on the belief that a certain strategy will deliver positive results over time, regardless of the economic situation, industry, market, or geography. Incidentally, this is another great advantage of trend following: its versatility.

Versatility and resilience

Namely, if you learn how to read price charts and formulate effective trend following strategies, you’ll be able to greatly enhance your universe of opportunities and participate profitably in many markets you might not know much about, like metals, energy, agricultural commodities or foreign currencies.

In the evolving new normal, a rigid adherence to the old thinking and business as usual approach to investing could prove dangerous. Adopting new approaches, including trend following, will provide investors with a degree of resilience that could make the difference between success and failure.

Trend following “bible” is free

For those who are inclined to expand their horizons, in 2021 I published a book titled “Alex Krainer’s Trend Following Bible,” which one reader described as, “no doubt one of the best books on financial markets and trading I have ever read!” The book is available as a free download at the link above. It is not free because it’s rubbish, but because Amazon cancelled me entirely (and appropriated more than 3 years’ worth of earned royalties).

Further resources are available on my website, I-System Trend Following. Active traders can subscribe to our daily TrendCompass reports which provide daily trend following signals on more than 200 global financial and commodities markets including all major equity indices, treasury bonds futures, commodities and some 100 FX pairs.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at TrendCompass@ISystem-TF.com

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. For more information, you can drop me a comment or an email to xela.reniark@gmail.com

The issue with the economy is that we moved from industrial capitalism to financial capitalism as primary. That's why many markets no longer match reality.

I suppose that's why you stick to commodities.

Industrial capitalism produces goods and services. Financial capitalism just produces more of itself. Buying stocks is basically bullshit these days because it doesn't infer ownership, you are just gambling with chips relative to the cap.

Nice, especially the reference to Sun Tzu.

The strategy I adopted after the great financial crisis is that of a more recent person, Jesus Christ; whose teachings were reflected in the moral code of conducting business until the medieval period. Following are excerpts from Robert D. Ingraham's "The Modern Anglo-Dutch Empire: its Origins, Evolution, and Anti-Human Outlook":

- There is no place in medieval theory for economic activity which is not related to a moral end

- The most fundamental difference between medieval and modern economic thought consists, indeed, in the fact that, whereas the latter normally refers to economic expediency, however it may be interpreted, for the justification of any particular action, policy, or system of organization, the former starts from the position that there is a moral authority to which considerations of economic expediency must be subordinated.

- Whosoever buys a thing, not that he may sell it whole and unchanged, but that it may be a material for fashioning something, he is no merchant. But the man who buys it in order that he may gain by selling it again unchanged and as he bought it, that man is of the buyers and sellers who are cast forth from God's temple.

Accordingly my strategy since 2010 was not to seek profit without work, rather to preserve value of savings earned from my machine building business. No speculation in stocks, bonds, or interest on savings in bank. Get out completely from the fiat casino and into solid gold.

13 years later, this strategy has paid off, purchasing value of savings has been preserved and is immune to any shenanigans that Money Powers can come up with or the monetary readjustment that will take place alongside the ongoing tectonic geopolitical change.