Japan: the harbinger of bad things to come

As goes Japan, so goes Europe, UK and ultimately the US too.

The accelerating collapse of Japanese economy will foreshadow the unravelling of the European, British and ultimately even American crises. It is time to pay attention as the crisis presents major risks – but also opportunities.

Things were discernible long ago…

Way back in March of 2010 I published an article titled, “Japan: the Harbinger of (bad) things to come,” opening with the sentence, “Large and gathering imbalances brewing in the Japanese economy threaten to generate a tsunami-like fallout that could soak most of the global economy.” At that time it would have been impossible to predict the current circumstances, but even back then it was clear that the policy makers took a wrong turn. In 2010, Japan was well in its 10th year of Quantitative Easing (QE), shoveling money from Bank of Japan’s (BOJ) printing presses at every economic problem. Ever since, QE has been the central bankers’ favorite solution to pretty much every problem.

Japan’s predicament was discernible for all with eyes to see. From my 2010 article: the “eroding household wealth in Japan has stalled demand for JGBs [Japanese Government Bonds]. This has contributed to a sharp rise in the ratio of government revenues generated from bond issuance to that generated by tax collection, from about 50% in 2007 to 90% in 2009. … With the government deficit running at over 40% of expenditure and Japan’s savers buying less government debt, who will finance Japan’s deficit in the future? The JGBs yield of 1.5% would need to triple before it could attract international bond investors.“

Seriously, who still remembers JGBs at 1.5%?

BOJ pulls out all the stops

The problems have only worsened over the past 12 years and after several rounds of ever bigger all-that-it-takes QE programs and stimulus measures, the BOJ has had to pull out all the stops and resort to buying unlimited amounts of 10-year Japanese Government Bonds. That was announced in February 2022. Not only that, the BOJ capped the interest yield at 0.25% to avoid inflating the domestic borrowing costs.

Well, if you conjure unlimited amounts of currency from thin air to finance government’s runaway deficit spending and you keep the interest rates suppressed below market levels, you are certain to blow up the currency. On 8 March this year, when the yen was trading around 115 to the US dollar I wrote in my daily TrendCompass report that the “yen will burn to a crisp over the coming years.” I also discussed that point in a podcast with Tom Luongo. Incidentally, that podcast has aged rather well considering everything that’s happened during the past six months.

Yen will burn to a crisp

We are now past 145 yen to the dollar, a new 24-year low and I’m afraid that we can expect that trend to continue. Although I don’t know how exactly to define a “crisp,” the yen is now only where it was in 1998. We can think of that time as the ‘good old days,’ before the BOJ even started its hare-brained QE arson. Since then, Japan’s central bank has painted itself into a corner: it’s got no option but to carry on with QE: it can’t raise interest rates, and while we can predict that the BOJ will try to defend the yen’s exchange rate, talk tough and bluster about, we can also predict that their efforts will fail.

What happens next

Broadly speaking, we can make three predictions about Japan’s economy:

We’ll see a period of stagflation (inflation + recession) and the inflation part could ultimately morph into a hyperinflation;

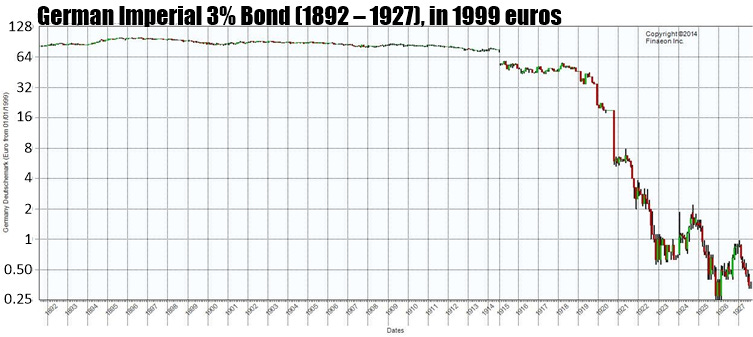

Interest rates will continue to rise and the price of Japanese Government Bonds will collapse. I believe that the unravelling could resemble what Germany had experienced 100 years ago (see below);

The Nikkei will rally

As currency and debt turn worthless, equities tend to go vertical as we saw in many cases through history, including Venezuela, Zimbabwe, Argentina, Israel and the Weimar Republic too:

Thus, as Japan’s inflation accelerates, the Nikkei will likely also go vertical. However, the nominal gains in yen will still leave investors with close to total losses in real terms. When Weimar inflation unwound in 1922, the total market capitalization of Daimler Benz was equal to the price of 327 of their cars. I suspect they must have had that many cars on their production lots and in their dealerships around Europe, so the company itself would have been close to worthless.

Real estate prices also collapsed in real terms: villas in the upscale neighbourhoods at the outskirts of Berlin could be bought for 100 US dollars (which were still gold-backed at the time). The reason why even real assets turn worthless is that inflation indiscriminately annihilates the purchasing power in an economy. It really is a great reset.

Why all this matters

In a recent podcast on Geopolitics and Empire, Doug Casey said something that may seem obvious, but it is extremely important. He said that, going into the coming apocalypse, the most important thing everyone should try to do is, preserve one’s wealth to the best extent possible. In this sense, the way Japan’s crisis evolves will prove relevant for most nations in the west; as goes Japan, so will the UK and the EU go. Ultimately, even the United States is sliding down the same slippery slope.

Profiting from the approaching apocalypse may seem questionable from the moral point of view, but I’m not sure what, if anything, is the virtue in letting yourself be swept away by a raging flood. Understanding the forces that are coming to bear on us is not a matter of profiting, but of self-preservation. You’ll be of no use to anyone else unless you can assure your own economic survival.

So what are the practical solutions? For all who might be interested, the full discussion of some practical problems (namely, uncertainty) and their solutions is included at my website at this link.

The chart below shows how the 12 strategies we use for YEN/USD in our Major Markets portfolio navigated the changes from 2020 through this week:

Today the Japanese, British, European and American crises may be discernible, but predicting the securities price trajectories is quite out of the question. Any investor’s best bet is to rely on high quality systematic trend following models. I-System TrendCompass should be a good place to start.