Read history and grow rich

All wars are bankers' wars. And many of their effects are predictable.

Former Fed chairman Arthur Burns said that “A subtle understanding of economic change comes from a knowledge of history and large affairs, not from statistics or their processing alone.” In that sense, seeking clarity about history and large affairs should be every investor’s core homework. Attaining clarity should demand that we look at things as they are, not as we wish them to be.

One of the principles of these large affairs of history seems to be the causal relationship between a nation’s geopolitical influence and their economic performance. The determining factor in that relationship is the nation’s access to quality collateral. The conventional narrative holds that Western powers’ influence in various places around the world is motivated by concerns like fighting terrorism and evil dictators while supporting freedom, democracy and human rights.

The naked truth of the matter has been easily accessible to anyone willing to discover it. Here’s an example: one of the U.S. preeminent court intellectuals, Zbigniew Brzezinski articulated why Eurasia matters to the United States:

“For America, the chief geopolitical prize is Eurasia… Eurasia is the globe’s largest continent and is geopolitically axial. A power that dominates Eurasia would control two of the world’s three most advanced and economically productive regions. … About 75% of the world’s people live in Eurasia and most of the world’s physical wealth is there as well, both in its enterprises and underneath its soil. Eurasia accounts for 60% of the world’s GDP and about 3/4ths of the world’s known energy resources.” (”The Grand Chessboard,” 1997)

Energy resources, wealth in Eurasia’s enterprises and underneath its soil, and its large population constitute quality collateral, which can fuel credit cycles in Western financial centers provided that they have decisive political influence over Eurasia’s key regions. Brzezinski wasn’t merely a theoretician of history or geopolitics; he was an influential policy advisor to many presidential administrations including those of John F. Kennedy, Lyndon Johnson, Ronald Reagan and Jimmy Carter. He wasn’t a lone voice either: we can find dozens of other officials and official government documents spelling out the same motivations driving foreign interventions.

Seeing things as they are

We may wish to see ourselves as do-gooders spreading democracy and freedom, as much as colonialists of the past wished to believe that they were spreading Christianity and civilization to savages in the “new world.” But that delusion would make it hard to understand those “large affairs” that shape the future of our world, and its economic consequences.

On 29 August 2021, about two weeks after the U.S. withdrew from Afghanistan, I wrote that, “The loss of Afghanistan not only stops the gravy train out of that nation, it also jeopardizes the Empire’s hegemony over its coveted Eurasian world-island.” The key problem wasn’t the loss of Afghanistan as such but what it revealed about the empire: that it can no longer control its Eurasian strongholds nor afford protection to its agents and allies there.

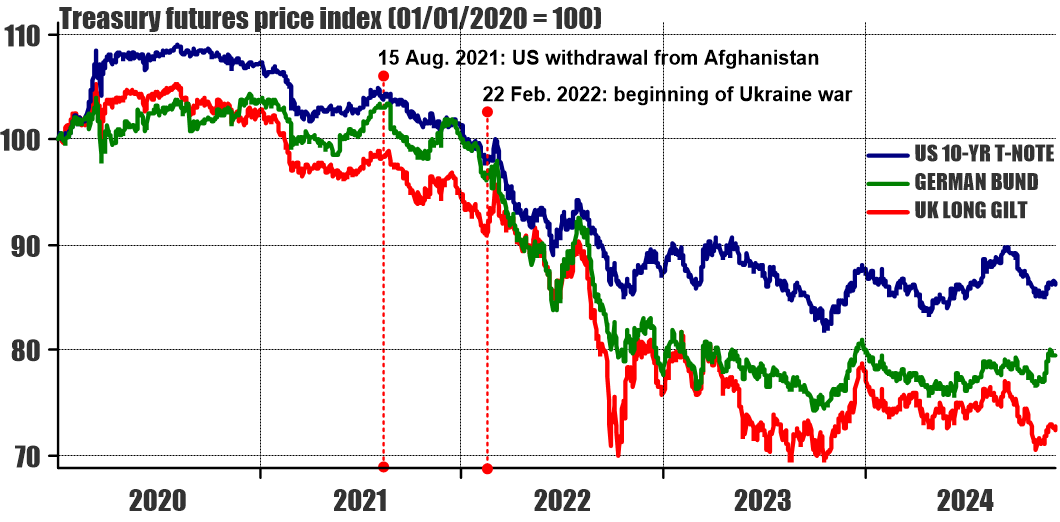

In the same article I predicted that, “Ultimately, this will exacerbate the already acute economic crisis in the west, primarily in the guise of higher interest rates which in turn affect pretty much everything else.” Over time, my hunch aged quite well:

During the second quarter of 2021, US, UK and German treasuries started to recover back toward their all-time highs, but that rally failed almost immediately after the U.S. pullout from Afghanistan. Only six months later, the war for Ukraine’s democracy and freedom started. At first, as the West hit Russia with massive sanctions, a wave of optimism pushed the bond prices higher, but that optimism was very short-lived. anyone who wished to look at things as they are, rather than as they wished them to be understood that Ukraine stood no chance in that war: even Barack Obama understood this in 2014 and declined to intervene militarily.

Markets trample the deluded

In their collective wisdom, the markets ultimately do recognize the reality of global events and mercilessly trample over those who remain attached to their wishful thinking. Those who could look at history and large affairs with clarity could have and should have come out richer. It’s not complicated: with the internet and the social media at our disposal, attaining that clarity should be easy. All that it requires is the willingness to do one’s homework and to reject the propaganda and deception that contaminate our information space.

How can we discern what’s true from what’s propaganda? That’s not complicated either: once we realize that the struggle is over collateral, we should know that the tales about democracy and freedom are false.

History continues

Today, the bond markets seem to be pricing in further adverse developments in Ukraine: the British and the Europeans, who have bet the proverbial ranch on Project Ukraine now seem on the verge of the next collapse in their bond prices. At the same time, the Trump administration has taken steps to cut their losses and extricate the United States from the trainwreck. As a result, U.S. treasuries have diverged from those of the UK and Germany, which now appears to be the weakest link in the West:

In this morning’s trading, German bund hit 126.87, the lowest price since 2011. In October 2023, the bund bottomed at 127.01 and in March of this year it bounced from the low of 127.18. The breach below the 127 support could make its downside wide open. Investors armed with clarity and an understanding of history and large affairs should be able to gain an advantage from future developments.

A word of caution

All of the above could have been written at any point during the last three years. While Arthur Burns’ dictum helps us predict long-term developments with a broad brush, they can’t help us predict bond price trajectories. If anyone shorted the bund in October 2023 when the bear trend was obvious, they’d most certainly get wiped out in the following three months. Even if they were conservative risk takers, they would still be sitting on losses until today.

Furthermore, the future could prove any prediction false. For example, if European governments respond to the current conditions with “financial repression,” (forcing Europe’s pension funds to buy government bonds), they could force interest rates lower and bonds prices higher. These conditions could reverse the current bear market and span a considerable period of time.

The onset, magnitude and duration of large-scale price events is unpredictable. While the narrative component of these newsletter strives for understanding and clarity about the past and the present, the only way I know how to determine the right timing for speculative trades is through trend following signals. For that reason, I always strongly advocate using systematic trend following as your guide through uncertain times.

The signals provided with this newsletter have proven effective in this sense as they build on the 25-year continuity of the I-System trends model. In all that time, tracking over 200 individual markets we never missed extending our sails into a large-scale price event as and when it unfolded and I believe that many such events lie in the near future.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at TrendCompass@ISystem-TF.com

NEW: Check out TrendCompass on Substack!

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. Further information is at link.

Of all the smart, intelligent and lucid individuals I have the pleasure of reading online, I wish to make a comment that you Mr. Krainer along with Martin Armstrong have the depth of historical clarity par excellence and am grateful for both of you sharing this knowledge. To add an anecdote from my history teacher, may he rest in peace, ''Today's politics is tomorrow's history''. Very grateful, thank you!

Seems clearer all the time that the US (the internationalists behind them, at least) setup Europe to be the fall guy with the Ukraine proxy war. Let them bleed themselves dry, cut off energy pipelines (literally and figuratively), replace their native populations, and then (likely) engage directly with Russia. Then the US and their bankers can offer ‘help.’

I just wonder how China fits into all this…