Untangling the "socialism" vs. "capitalism" dichotomy

Everybody has an opinion and (almost) everyone is wrong

Few ideological dichotomies polarize opinions as readily and as completely as that between "socialism" and "capitalism." Those who embrace socialism tend to blame capitalism for everything that's wrong with our world today. Those who embrace capitalism harbor a seething contempt for socialists, but both camps base their views on ideology with only vague notions about the true nature of either system.

The “socialists” think of capitalism as a rapacious system of exploitation that favors a few at the detriment of many. There is some truth in that. The "capitalists" think of socialism as a system that gives free stuff to the lazy and undeserving, choking society's progress. There's some truth in that too, but having lived in both systems and having experienced the ideological brainwash from both sides, I find neither side convincing.

So, you’re a communist!?

Both systems’ ideological foundations amount to marketing, the intellectual gloss on the cover of their respective sales brochures. But the gloss never captures the essence of either system - an omission that is so egregious that it is almost certainly deliberate. Clear understanding of the essence of this dichotomy is not encouraged and instead of exploring all the relevant issues, on both sides of the ideological divide people readily resort to derogatory labels which usually shut down the much needed open minded discussion.

Last week I had the privilege of participating in a "Capitalist Exploits" conference in Dubai. The event was by invitation only and attended by about 70 participants, all successful entrepreneurs and investors from all over the world. Our various discussion panels covered a lot of ground including health, technology, investing, politics and geopolitics. For my humble contribution I had the honor of being called a communist. This was in jest and not with malice, but as they say, there's some truth in every joke. I earned the distinction simply by questioning the ideological orthodoxy prevalent in the "capitalist" Western world.

As someone who grew up in the Communist block and experienced the Marxist brainwash, being called a communist felt comical: I'd rejected the Marxist ideology already as a teenager, not because I had any deep understanding of the economic and socio-political issues we faced but because the system wasn't delivering as advertised: it was clearly evolving in the opposite direction from the promised utopia.

At the age of 17, I moved to the "capitalist" United States which appeared to be based on a much, much superior system to the one I knew. The U.S. economy was vibrant with entrepreneurship and innovation and the American people seemed significantly more prosperous than we were. But the more I learned about the "capitalist" system, the more I became convinced that the same seed of doom that made "socialism" unsustainable was also baked into the foundation of the "capitalist" system.

For starters, in both systems we had the familiar old fiat currency with fractional reserve lending. This one element guarantees the collapse of both systems: over time it reliably corrodes the democratic framework of society, suffocates free market economy, kills entrepreneurship and innovation, and guarantees that government sector of the economy will gradually displace more and more private enterprise. It does this due to an economic effect called the deflationary gap.

Deflationary gap

The following few paragraphs may seem convoluted but please bear with me, we’re getting to the essence of the issue at hand. To understand the deflationary gap, let's consider a closed economic system that produces a certain quantity of goods and services. By “closed” I mean that we'll assume the system has no foreign trade.

The total of all the price tags attached to the goods and services produced is the aggregate cost of the system’s output: it represents the amounts of money expended by the businesses on things like raw materials, wages, rents and interest plus the entrepreneurs’ profits. These sums are income to those who receive them and also comprise the system’s total purchasing power. On the whole, the aggregate costs, aggregate incomes and aggregate prices are all the same, because they represent the opposite sides of the same transactions.

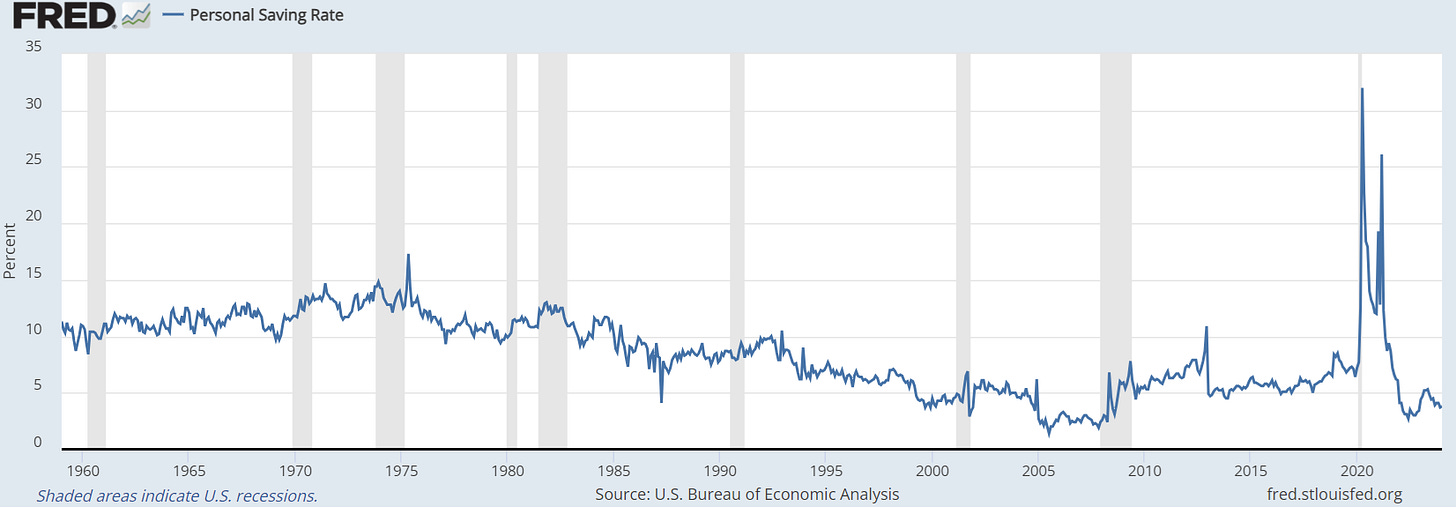

The prices at which the system’s output can be sold in the marketplace are determined by the total amount of money which is available for spending in a given period of time. For the system to be in equilibrium, aggregate prices should exactly absorb the system’s total purchasing power. But a problem arises because in the current monetary system, there are two factors that significantly reduce the system’s purchasing power: (1) savings and (2) debt repayments.

Namely, people don’t always spend all of their income. Instead, they prefer to set aside a part of it as savings which has the effect of reducing the total purchasing power available in the system.

So, if there are any savings, the available purchasing power will be less than the aggregate asking prices. For the system to remain in balance the savings would have to reappear in the market in the form of investments, but if total investment is less than total savings, the purchasing power will still fall short of the amount needed for all of the output to be sold at asking prices. This shortfall of purchasing power in the system, the excess of savings over investment is the deflationary gap.

The other systemic drain on purchasing power (hat tip to author Liam Allone for pointing this out to me) are debt repayments: since (nearly) all currency enters into circulation as debt, paying down debts extinguishes the currency and the purchasing power with it.

Without government intervention we get a depression

The system can be balanced either by lowering the supply and prices of goods, by enhancing its total purchasing power, or a combination of both. Lowering prices and production of goods will stabilize the economic system at a low level of economic activity. Increasing the purchasing power in the system will stabilize it on a higher level of activity.

Left to itself and without intervention, a modern economic system would fall into a self-reinforcing deflationary depression: the deflationary gap would lead to falling prices and output, decline of income and rising unemployment. Furthermore, in recessions and depressions, the level of investment typically declines even more rapidly than savings. To avert this, government intervention is necessary.

Without government intervention, the economy would stabilize when the level of savings declined to the level of investments which would be at a depression level of activity. This is an anathema in all modern economies, and governments invariably pursue the imperative of economic growth. To generate growth, they must inject new purchasing power into the system. This cannot be done through taxation since taxation doesn’t create new purchasing power: taxes only transfer money from those who earn it to the government.

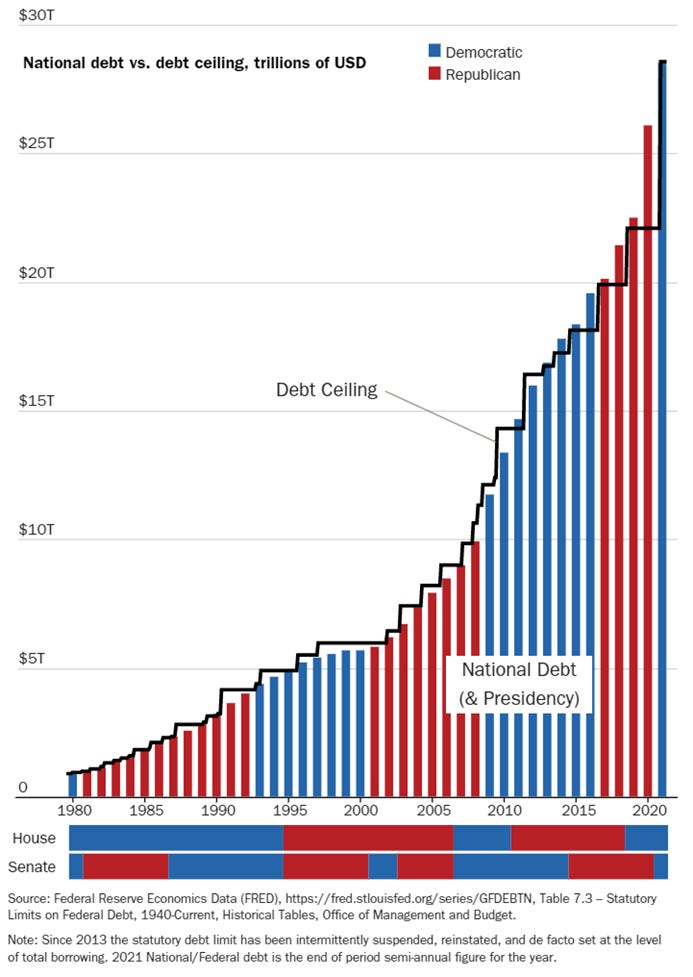

This is why governments have no alternative but to continuously engage in deficit spending, adding debt in excess of their tax receipts. This is why virtually all governments in the world today run budget deficits and grow public debt. In spite of all the incessant talk about balancing the budget, paying down debts or imposing debt ceilings, the debts only keep rising at rates that predictably accelerate over time. It doesn't matter whether we call the system “socialist” or “capitalist,” they both necessitate an ever growing role of government in the economy.

Today, in many of the “capitalist” nations, government spending accounts for almost half of the GDP and in some cases significantly more. In the UK, the mothership of capitalism, the government's share of GDP is 44%. In France it's over 58%.

The great American debt ceiling Kabuki theater

In the United States, for over a century now we've been treated to periodic reruns of the “debt ceiling” Kabuki theatre. When public debt reaches the “debt ceiling,” free-spending socialists call for more government spending and a raising of the debt ceiling. The conservatives enjoy grandstanding about fiscal conservatism and balancing budgets, but regardless of which side controls the Presidency or the Congress, for over a century now the debt ceiling has been raised every time. The only exceptions have been periods when the ceiling was simply ignored and the public debt continued its accelerating upward trajectory:

You get socialism, whether you like it or not!

Averting depressions and achieving economic growth necessitates government intervention and guarantees an accelerating rise in deficit spending with the corresponding rise in public debt regardless of whether we are talking about a “capitalist” or a “socialist” economy. This should be obvious, as the evolution of public debt in the U.S. illustrates:

There’s no point railing against “socialism” and dreaming about a small government, private capital utopia which doesn't, and cannot exist so long as our economies are based on fiat currencies with fractional reserve lending. Even if we start with zero public debt, the pursuit of economic growth will lead to the same outcomes.

With fullness of time, government sector will progressively crowd out private enterprise: it’s a mathematical certainty. As a result, we get socialism whether we like it or not. Even if a political leader declares himself to be an anarcho-capitalist and thinks he can create the capitalist utopia (like Argentina's Javier Millei), the endgame will be the same.

The passionate disciples of capitalist ideology will protest and invoke the theoretical works by economists like Ludwig Von Mises, Murray Rothbard or Friedrich Hayek but I would simply ask them to please name one real-world example of a successful free market capitalist economy where the government never ran budget deficits and piled up public debt. I can wait.

For those who would defend the free market ideology and excuse its failing as a consequence of human corruption and weakness of the structures of society, I’d warn them that this was exactly how Marxists explained away the failures of communist utopia. The theory is awesome, it’s the damn people who can’t get it right!

Top-down or bottom-up?

With that, we can address the false dichotomy between “socialist” and “capitalist” economies as they're commonly discussed. Namely, in what we call “capitalist” economies, a larger proportion of government-injected purchasing power flows top-down. In what we call “socialist” economies, it flows bottom-up.

Capitalist governments splurge their largesse on large private corporations in the form of subsidies and generous government contracts. Socialist governments splurge on social welfare programs like low-cost or free health care, education, generous unemployment benefits and pension plans, and programs that maintain full employment even where jobs couldn't be justified by private enterprise.

It’s what the “capitalists” hate. As a rule, individuals who strongly favor free market capitalism tend to be the successful, entrepreneurial types who value risk taking, hard work and creating wealth through private initiative. The idea that the state would splurge on the lazy and undeserving free-loaders is understandably revolting. But if you’re an entrepreneur, all those undeserving free-loaders might also be your customers, so even the hard-core business men benefit if the lazy bums have money to spend.

The alternative in governments splurging on large corporations is far more dangerous. If purchasing power is distributed bottom up, the decisions about how to spend money are up to the ordinary people. As such, they'll tend to benefit ordinary businesses that produce consumer goods and services: bakers, apparel makers, restaurants, coffee shops, musicians, tour guides, bicycle repairmen, etc.

By contrast, if the state spends top-down, it runs the moral hazard of determining the winners and losers in the supposedly free market competition. The winners will tend to be those corporations and groups that can “invest” the most in political lobbying efforts. As a result, we get the TBTF banking behemoths, big Ag, big Pharma, big Media, big Tech and a massively bloated military-industrial complex. Ultimately, this favors the emergence of corporatism, as Benito Mussolini characterized fascism. Today we prefer the sanitized term, “private-public partnership.” The adverse effect of all this is a society’s addiction to permanent wars and a penchant for empire-building.

Does this make me a communist?

These are the musings that get me labelled “communist,” but, whatever. If we want to fix what's wrong in the world today it is essential that our analysis goes past the handy but misleading labels of “socialism” vs. “capitalism,” or left vs. right, and that we deconstruct our challenges down to their essential building blocks.

The labels merely maintain an entrenched ideological divide, enabling each side to disqualify the other without ever having to stop and actually think things through. In that, the labels only perpetuate our problems and make it difficult to transcend the dysfunctional elements in our system and evolve toward better social arrangements.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at TrendCompass@ISystem-TF.com

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. Further information is at link.

I love the way you presented this, Alex. I was a staunch capitalist business-minded person from a young age... until I faced the clash between my attitudes and Eastern upbringing. I knew capitalism offered a sensible and logical direction, but that so did the collectivism generally part of Eastern cultures. It was always a tug-of-war in my head and I wonder if humans will one day devise the system that survives human frailties.

Capitalism and communism are the flip sides of the same coin. Both in practice seem to evolve into mechanisms of state largesse with an exploitive and oppressive/coercive broad and deep control system over their populations. Tyranny.