Stock markets: is a 50% decline imminent?

Why are many analysts predicting it and how to navigate through the storm?

Over the last week, a number of prominent market analysts expressed concerns that US stock markets could be in for a large correction or even an extended bear market. In an interview titled, "Decade-long bear market ahead..." Marc Faber contends that we are already in recession and that this would show if the statistics were presented in an honest way. Faber expects the market downturn to begin in May-June period of this year and points out that the stock prices are still relatively close to their peak values. Therefore, the correction could take a long time, says Faber: "you're not going to make a lot of money for the next ten years," in stocks. Instead, he expects the next 10 to 15 years to resemble the period between 1966 and 1982 during which the real returns on stocks and bonds were negative.

Veteran hedge fund manager Jeremy Grantham also warned about the risk of a large and imminent market correction. Grantham notes an ongoing deterioration of financial conditions and believes that a crisis in the housing market could trigger the final phase of the financial bubble with the S&P 500 dropping to 3,200 by year end 2023. Grantham's worst-case scenario would be a 50% decline to about 2,000, which could extend deep into 2024.

Stocks and the “Presidential cycle”

Perhaps the most interesting part of his analysis regards the timing of the correction: he expects that it will begin in May of this year and suggests that this is related to the "Presidential cycle." Namely, the October through April period of a presidential administration's 3rd year tends to be the most bullish period for stocks. According to Grantham, stock performance during those seven months have equalled the remaining 41 months in all presidential cycles - a pattern that's held since 1932!

Here's how he explains the phenomenon: every president wants a strong labor market in the 6-month run-up to the elections so that the voters feel favorable towards his administration and his party. Therefore, the administration seeks to stimulate the economy well in advance of the election cycle, since the impact of the stimulus only filters through to the labor market with a lag. Before that, the stimulus tends to have a more immediate impact in the stock market, which is why the seven months from October through April of the administration's 3rd year tend to be the most bullish for stocks.

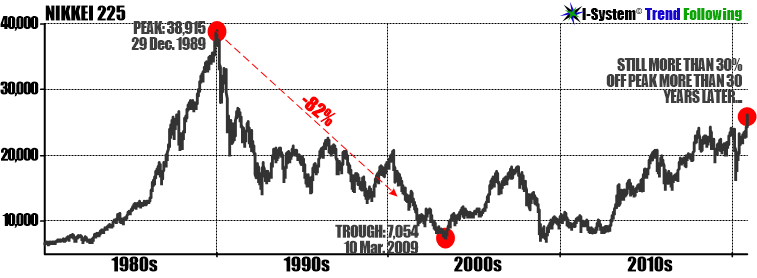

For the Biden administration, this seven month period will expire at the end of this month, which is why Grantham believes that the next leg of the downturn begins in May. Grantham adds the quip, “sell in May and go away…” Importantly, he warned that this might not be just a mild decline but rather an event comparable to 1929, 1973 or 2000. Today's crisis is significantly worse than what we experienced in 2000 because it involves not just the stocks but also bonds and real estate, which is why Grantham is more inclined to expect his worst case, -50% scenario, reminding that in 2000 Nasdaq dropped by 82% and the S&P 500 by 50%.

A 50% probability of a 50% decline?

There's a 50% probability that Faber and Grantham are right (they either are or they aren't) and I much prefer to remain agnostic about the future trajectory of security prices. History offers many examples where economic crises actually led to a sharp appreciation of asset prices. Where I do agree with both Faber and Grantham is that we will likely experience very significant price events in the markets, whether on the upside or otherwise.

Time to recovery

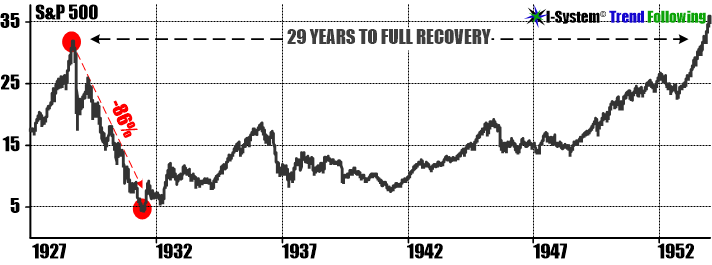

Another serious concern if Grantham’s and Faber’s predictions come to pass, is the time the markets will take to recover after such a strong correction. Over the last 40 years, even very brutal corrections and/or bear markets recovered within a few years. But real, severe bear markets can take decades to recover as we saw in the aftermath of the 1929 crash:

The Japanese stock market still never recovered after its 1980s bubble collapsed:

We can’t know what the future holds, but the range of possible outcomes today is very concerning.

Trend following beats prediction

But instead of guessing which prediction is wrong and which is right, investors will be better served by relying on systematic trend following strategies - at the very least as a source of second opinion about the unfolding trends. Trend following is the most reliable way to make sure you are on the right side of large-scale price events, whatever their direction.

The chart above illustrates the performance of a typical I-System strategy during the 2008 financial crisis. Of course, the algorithm did not "know" to sell at the top nor buy at the bottom. But it also didn't need to worry about predicting future events. Instead, it generated large windfalls during both bull and bear cycles by simply reacting to market trends as they unfolded.

For trend followers, even a bear market can be golden

Markets move in trends and trends can be advantageous even in a down cycle. Unburdened by convictions and opinions that might ultimately prove wrong, trend followers can profit during bull market cycles and during bear markets. As Sun Tzu knew more than 2000 years ago: there are three avenues of opportunity - events, conditions, and trends. For solutions, please see below:

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass reports which cover over 200 financial and commodities markets. For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. For more information, you can drop me a comment or an email to xela.reniark@gmail.com

50%-down, in real value is without doubt, highly plausible with the coming 1-1½ years. Regarding the usd & euro. Among other currencies.

The P/E traditional method of evaluating stocks/bonds, 'flew-out-the-door' permanently(!) in 2008.

Certain...metals, will see...tremendous increases.

I remember opening my *Credit Suisse*-account in Cairo 1979 and...within 6-8 months after my purchase of 1+kg Gold parked at the Zürich Airport Depository increased over 3-fold(!!!).

In the Spring of 1980, I met for the 1st-time my own..'private banker' on the Hofbahnstrasse in Zürich. Maurice G, on the 2nd-floor. Persian rugs and crystal-Chandeliers. Nobody else except...the..'concierge(cough-cough). "Want some coffee or tea before M.G. meets You?".

Well. Ok.

Long-story-short. I believe *precious metals* will...accelerate in price, when the 'stock markets drop' dramatically. The time period is...as You-Alex know, a very-short-window.

My own advice is...get-in...then get OUT(!)...ASAP! The timing is critical.

Any...'advice/comments/suggestions Alex'?. Of course...U-don't-ain't givin' no finance advice here...wink-wink :))

Best Regards Chris

Imagine. The 'perfect shot'.

i.e. Ronald R , coming down the ca. 500m incline from, Töölö/Mehlathi, slowing -down to swing-left at/by Munnkineinipouistie, on RR's journey to meet for the 1st-time, Mikael Gorbechev 1988.

Yep. "talkin' about the-swing...left"....kind'a like JFK.

https://duckduckgo.com/?q=reagan+gorbachev+1988&t=ffab&atb=v224-1&ia=web

Or, perhaps, Tony Hagström's HQ's at Televerket's HQ at Gamla Stan.. Slottsbacken...1990-91.

Only about 30meters dirctly across from the *Castle Sweden*.

https://duckduckgo.com/?q=Tony+Hagstr%C3%B6m+televerket&t=ffab&atb=v224-1&ia=web

https://en.wikipedia.org/wiki/Gamla_stan

Or, perhaps, direct daily contact with M. Wallenberg, scion of the Wallenberg-banker-investor oligarchs/SEB-Investor, at Sergels Torgs HQ, in the middle-of-Stockholm 2004. https://duckduckgo.com/?q=Marcus+Wallenberg+SEB&t=ffab&atb=v224-1&ia=web

I abhorred violence. I'm sooo glad, the MK-Ultra...'thing'...never ever gained traction with Me. Yep. Irrespective of Karma, I will never do anyone's 'dirty work'.

100%-True. On My Mother & Father's Grave.

AMEN