The sequence of events that took place during the last few months of this year, including the presidential elections in the United States and the war in Syria overshadowed important developments in the news cycle, especially on the economic front. One of them is the approaching collapse of Great Britain.

I believe that we are close to the precipice of events that will remain recorded in history, perhaps like the 1921 Weimar republic hyperinflation, 1929 stock market crash, or the collapse of the Soviet Union in 1991. The events will cause a lot of pain for great many people, but if we correctly anticipate them and prepare for the coming changes, at the very least we should be able to weather the storm intact.

About three months ago, on 26 August I published an article titled “The coming collapse of Britain.” If you missed it, give it a scan as it sets the backdrop to this report. During this year’s summer months, British ruling establishment appeared to be in a panic over Ukraine’s imminent military defeat and her debt default. Britain has invested quite massively in project Ukraine, which now looks like a failed investment.

Indeed, on 27 August, only one day after I published that article, Prime Minister Keir Starmer gave a speech in the Downing Street garden, in which he disclosed that there was a “£22 billion black hole in the public finances.” Supposedly, his government only discovered this once they came to power. By “black hole,” Starmer was referring to the government’s unfunded liabilities.

Catastrophic fiscal conditions

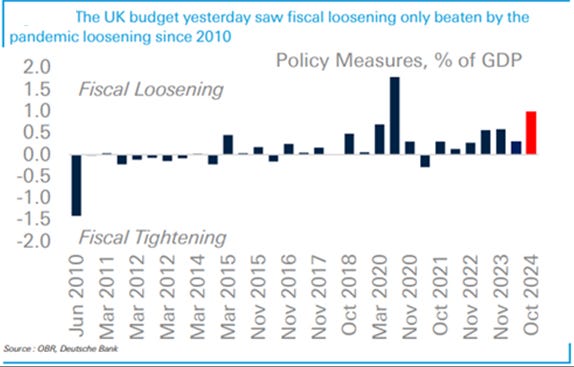

To prepare the nation for more bad news, the Prime Minister announced that the October 30 budget would be “painful.” Well, October 30 is behind us and now we know. When the news broke, Deutsche Bank’s analyst Sanjay Raja characterized the budget as, “one of the largest fiscal loosening of any fiscal event in decades.” In the post-war years it was only surpassed in 2020 due to the Covid 19 lockdowns.

The new budget adds £142 billion in new debt, which the government expects to raise in capital markets. But the sheer amount of the planned borrowing took the markets by surprise. As it turns out, Britain’s gross financing needs are double what market analysts had expected.

The painful side to the budget which Mr. Starmer promised will come not only in terms of savage austerity imposed on society’s most vulnerable groups but also in terms of £40 billion in new taxes. The burden of these new taxes will fall largely on British employers, which will in turn hurt the working people. Ultimately, it will also hurt the government. In suffocating the economy, the government will only widen the gap between public spending and its tax receipts. Britain is already running one of the world’s largest budget deficits. Bloomberg’s analyst Simon White had a point when he judged the fiscal picture in Britain as catastrophic.

Lipstick on a pig

UK’s Office of Budget Responsibility (OBR) applied lipstick on the proverbial pig with some suspiciously rosy-looking forecasts. They projected that the government’s budget deficits will stay at around 2.5% through 2029. Inflation will stay perfectly under control, peaking at 2.6% in 2025 and then gradually fall back to 2% by 2029. The OBR also revised Britain’s 2024 GDP growth rate to 1.1%, up from 0.8% in March. In 2025, the GDP growth will soar to 2%.

Reality begs to differ

But the government might be a bit optimistic with all these figures. The Organization for Economic Cooperation and Development (OECD) recently downgraded Britain’s economic prospects. They predicted that in 2024, the UK will have the worst performing economy among all the G7 nations with an expected growth of only 0.4%, not 1.1%; and 1% in 2025, not 2%.

But as it now turns out, even the OECD was much too optimistic. Namely, the official figures show that the British economy actually shrank 0.1% month-on-month for two months in a row, in September and October 2024

Bold financial innovation

But there’s more: to show itself in its best light, the government even resorted to bold financial innovation. Namely, they disappeared a large chunk of the public debt by simply redefining it.

In doing so, Keir Starmer’s cabinet gave itself £53 billion in extra borrowing capacity. If the capital markets embraced this bold 21st century financial innovation, all governments, companies and individuals around the world might want to follow suit.

If you've maxed out all your credit cards, additional borrowing headroom could be just a simple matter of identity politics. You could declare your debt an asset and perfectly good collateral at that, and progressive creditors should have to respect and honor your choices. The 21st century may not have brought us flying cars, but the financial innovations are just as exciting. Who knows, perhaps we could achieve further advancements by declaring that war is peace, slavery is freedom, vaccines are safe and effective, and that ignorance is strength.

Unfortunately for the government, however, all these innovations failed to impress Mr. Market who punished Starmer’s profligate budget within hours by selling off the government debt and adding 20 basis points to the interest rate on the 10-year British gilts.

The good old days of 2022

But this reaction was quite minor compared to what happened in September 2022 when Chancellor Qwasi Qwarteng presented the Truss cabinet budget. The so-called mini-budget shocked the markets with £45 billion in unfunded spending commitments. There’s “only” £32 billion in unfunded commitments in the current budget, but there are a few reasons why the situation today could be much worse than what Britain was facing in 2022.

Back then, Britain was not yet as heavily invested in the wars in Ukraine and in Israel. In 2022, many people believed that Ukraine would prevail. This is no longer the case today. Also, in the summer of 2022, the interest rates on 10-year gilts were well below 3%. Today they’re over 4.5% and rising. In fact, the sharp rise in interest rates since 2022 itself indicates that the situation could be worse than we know.

The most important indication that something was very wrong was the fact that the Bank of England (BOE) felt obliged to open the monetary spigots wide. Recall, on 22 July they hastily introduced a repo program, announced as a bold “transition towards a new system for supplying reserves” to financial institutions. This move was clear evidence that one or more of British financial institutions were about to collapse.

By September 5, the program already ballooned to over £40 billion. We’ll take a small detour to talk about repos here because it’s important to explain what repos are and why BOE’s launching a repo program is significant. If you feel you know enough about repos, feel free to skip to the next heading.

The repo red flag

Repos or repurchase agreements are an important source of funding for large financial institutions. A repo is a form of borrowing where the borrower sells securities to the lender with an agreement to repurchase them at a slightly higher price. Simply, it’s a form of secured loan. In the first step of the transaction, the lender buys some financial assets from the borrower.

The assets also represent the collateral which secures the loan. Normally, the collateral in question would be highly liquid, low-risk securities like government bonds, but they could also be mortgage-backed securities. In the second step, the borrower repurchases the securities at a higher price. The difference between the sale and the repurchase price reflects the interest on the loan that’s due to the lender. The lender might also demand that the loan be overcollateralized: that the value of the collateral exceeds the purchase amount by some percentage.

Repos are usually very short-term transactions, most often overnight, but they can also be arranged for longer time intervals spanning several days or several weeks. They can also be open ended, with no term specified. As a rule, in repo transactions the lenders are private, non-depositary financial institutions or money market funds. For them, repo transactions are a lucrative source of investment returns as they earn reliable interest income in transactions that are almost risk-free. The borrowers are usually investment banks for whom the repo market is a critically important source of liquidity.

In the U.S. over a $1 trillion in repo transactions are conducted each day. During financial crises, however, the repo market is one of the first to seize up. If a borrower is unable to repurchase the securities they sold, the lender might remain stuck with the collateral. In a crisis, the value of that collateral could collapse. In such conditions, the lenders might demand higher interest rates and higher rates of recollateralization. They might even be unwilling to engage in repo transactions at all.

In 2007, the Global Financial Crisis was catalyzed by a run on the repo market: the funding for investment banks became either prohibitively expensive or entirely unavailable. At that time the Fed did not enter the repo markets, but Ben Bernanke injected at least $1.5 trillion of liquidity by purchasing financial assets through other, longer-term facilities.

In 2019, yet another financial crisis was about to hit the proverbial fan. In August 2019, the President of the Federal Reserve Bank of St. Louis, James Bullard said that, “Something is going on, and that’s causing, I think, a total rethink of central banking and all our cherished notions about what we think we’re doing… We just have to stop thinking that next year things are going to be normal.” Well, as we now know, within a few months we got the New Normal!

The repo rates in the U.S. have been rising steadily since 2015, but by 2019 that trend began to accelerate quite sharply. On 16 September, repo rates exploded to 8%, fully 6% above the Fed Funds rate.

To avert another, much bigger Lehman Brothers moment, the Fed hastily intervened as the lender of last resort, providing tens of billions of dollars in liquidity to the repo markets. The intervention was supposed to be only temporary. The Fed’s repo facility was meant to be shut down by 10 October 2019. Except it wasn’t: instead, it continued to expand from the initial $53 billion to surpass $200 billion by the end of October.

We don’t know the full story however, because like the British authorities today, the Fed kept things very obscure. Writing about the episode in January 2022, Fed Watchers Pam and Russ Martens wrote that, “We’ve never before seen a total news blackout of a financial news story of this magnitude in our 35 years of monitoring Wall Street and the Fed.” The Fed never had disclosed which banks got how much repo cash[1]. The reason for all the secrecy was that the problem was much bigger than we were told and it wasn’t limited to the United States.

On Saturday, 19 October 2019 the World Bank Group and the International Monetary Fund held a meeting in New York. On the occasion, UN Secretary-General António Guterres spoke and underscored that the world economy was in “tense and testing times,” and facing severe headwinds. He pleaded with the overlords of global finance to “do everything possible” to avert the “the possibility of a Great Fracture” in the world. By January 2020, we had numerous reports about interbank lending and commercial credit drying up in Europe, with banks issuing margin calls and cutting credit lines. It appeared that a massive financial crisis was imminent.

But just then, a miracle happened!

But just then a fortuitous event almost miraculously rescued the banking system. The World Health Organization declared the Covid 19 pandemic, creating the perfect smokescreen for the bankers to stage a veritable global banking coup followed by the largest ever bailout of the entire Western financial system.

In the U.S. the CARES Act was passed, providing a $6.2 trillion ‘stimulus’ package for the economy. How much is $6.2 trillion? It is nearly $20,000 per man, woman and child living in the United States. Not only that, US lawmakers somehow had the foresight to introduce this Act into the Congressional procedure already in January 2019, more than a year before the pandemic was declared.

Ultimately, the total bailout gifted to the bankers exceeded 10 trillion dollars – well more than $30,000 per man, woman and child living in the United States.

That sum clearly dwarfed the Fed’s repo facility, but the repos were essential in averting the collapse in September 2019. Thanks to their opacity and complexity, repos saved the day as a sort of a Swiss Army knife in the bankers' survival toolkit. For example, they can serve as a means of perpetual bailout: among others, Lehman Brothers systematically used repo transactions to conceal their investment losses and create for a time a false impression of liquidity. For central banks, repos can be a covert mechanism of monetary policy. The Reserve Bank of India routinely uses repos and reverse repos to increase or decrease money supply in the economy.

Today, it seems that we are at the precipice once more. Keir Starmer’s budget represents the largest fiscal loosening since the 2020 lockdowns and the Bank of England is flooding the financial system with liquidity. It is fair to ask then, how bad could things be in the UK?

The black hole: £71 or £22 billion?

I don’t really know the answer to that question. As a market analyst and a former hedge fund manager, I regularly read the financial press, and I’ve done so for over 25 years. But over that time, I couldn’t help noticing that UK’s public finances aren’t subject to the same level of scrutiny as those of other nations. We hear a lot about the US, Japan, Germany, France, or China. About Britain, not so much.

What we can find from public sources isn’t exactly sensational. We already know that UK’s government debt is high and rising; in 2023 it was nearly £116 billion, 27% more than the year before. UK’s Office of National Statistics says that the government added £64.1 billion in deficit spending through August this year and that debt-to-GDP ratio reached 100%.

The figures are bad, but they’re hardly panic-inducing stuff. I suspect that the real state of things is much worse and that it is being deliberately concealed.

There are times however, when some truth breaks into the public view through political squabbles. For example, on May 1 this year, Kier Starmer confronted then Prime Minister Rishi Sunak about the £46 billion black hole before correcting himself, first to £64 billion and then to staggering £71 billion! Whatever the case, the “black hole” is there and it is probably much bigger than we know. Of course, by the time Starmer became Prime Minister, the hole had magically shrunk to ‘only’ £22 billion – the sum that’s perhaps small enough that it can be fixed in part by freezing a few thousand pensioners this winter.

The system that demands human sacrifice

Incidentally: what is this financial system that requires a limitless flow of free money to gorge the gods of finance while at the same time it inflicts savage austerity on the poorest and most vulnerable members of society, condemning many of them literally to death. Whatever the Gods of finance are, they clearly demand human sacrifice. Our liberal democracies fear these gods enough that they are prepared to appease them at an industrial scale.

To save about £1.4 billion, Sir Keir Starmer has decided to cut winter fuel subsidies to 10 million pensioners in Britain. Back in 2017 Tory Prime Minister Theresa May floated a similar proposal. At the time, Labour was in opposition and their own research concluded that cutting winter fuel allowances would kill an estimated 3,850 pensioners that winter. That was five years before "typical household energy bills increased by 54% in April 2022 and 27% in October that year.

Britain now has the highest cost of energy in the world and the required human sacrifice could turn out considerably higher than 3,850 pensioners, all to save a relatively insignificant sum of money: a mere £1.4 billion of the supposed £22 billion fiscal black hole.

What they’re lying about…

To be sure, Starmer was almost certainly lying about the size of that black hole. Massive government spending on unproductive, ideologically driven pet projects had created a £50 billion black hole already in 2022. The cost of Covid counter measures was £9 billion. Government’s Orwellian track and trace program cost £37 billion. In addition, vast sums are being spent on various net zero schemes.

Just in 2022 the government spent £12.79 billion on “mitigating the impact of climate change,” whatever that is. Furthermore, at the beginning of October 2024 they announced they'd allocate another £22 billion for carbon capture projects, building facilities to capture carbon from the atmosphere and store it underground. To be fair, the said amounts will be spent over a period of 25 years, but still, this is just more and more billions wasted on completely unproductive projects, far into the future. Starmer’s government also added £2.9 billion to Britain’s “defence” budget, a 4.5% increase over previous year’s budget and more than twice as much as they’re saving by freezing the pensioners.

The illegal immigration black hole

Then there’s immigration: supposedly, the upkeep of illegal migrants costs the government £8.5 billion per year. But the actual cost is almost certainly much, much higher. Back in 2009, we were told that the cost of immigration was £12.8 billion per year; in 2016 they said it was £17 billion, and since then the number of migrants increased by more than 2 million, so the cost of their upkeep would not have halved since 2016. Most likely it would have increased and dramatically so.

Then there’s the all-consuming Project Ukraine. From February 2022 until now, Britain allegedly spent more than £13 billion in aid to Ukraine. But the real damage from this misadventure cost many times more. Sanctions against Russia have caused extensive damage to Britain’s economy, starting with a sharp increase in prices of energy and other inputs. Farmers reported that the cost of fertilizer has quadrupled, from £250/ton before the sanctions to £1,000/ton today. Many British companies lost business on account of sanctions.

Just one example was British Airways' cancellation of one of its most important routes: the 4-times weekly direct flight from London Heathrow to Beijing. In a retaliatory measure against British sanctions, Russia closed its airspace to British commercial flights, rendering it uncompetitive and simply surrendering the business to BA’s Chinese competitors. There are probably thousands of similar cases where business relationships that may have taken years and decades to develop have been blown up over the ruling establishment’s geopolitical obsessions.

Russia sanctions - the staggering collateral damage

It would be difficult to quantify all the effects, but in June 2023, European High Representative for Foreign Affairs Josep Borrell gave us an important clue. Here’s what he said in his remarks to the Shangri La Dialogue forum in Singapore:

“For the first time ever, we have been funding military support to a country under attack. … if you add up all the support – military, civilian, economic, financial and humanitarian – the level of support to Ukraine is about €60 billion for Europe. But let me show another figure which is really impressive: if you include the support that the European governments have had to pay in order to help their families and firms to face the high prices of electricity, of food, the subsidies to our people in order to face the consequences of the war is €700 billion – ten times more than the support for Ukraine. Which shows that the consequences of this war are not reduced to what’s happening in Ukraine but to the shockwaves that the war has been sending all around the world.”

If the shockwaves Borrell was talking about hit Britain as hard as they hit the EU nations, the full cost of Project Ukraine could be £150 billion or even more. Keep in mind, Borrell made his assessment only half way through the Ukraine war. However high the real damage is, all that capital has already been flushed down the drain and will likely never be recovered.

In all, the situation in Britain is certainly far worse than we know. Over the top, Orwellian actions by the Starmer government and the Bank of England seem to support this view. What we have, in a nutshell, is an overhang of unpayable debts, growing government deficits, hard austerity, increasing militarization, continued foreign adventurism, not only in Russia but also in the Middle East, and an expanding monetary inflation by the Bank of England.

The markets verdict

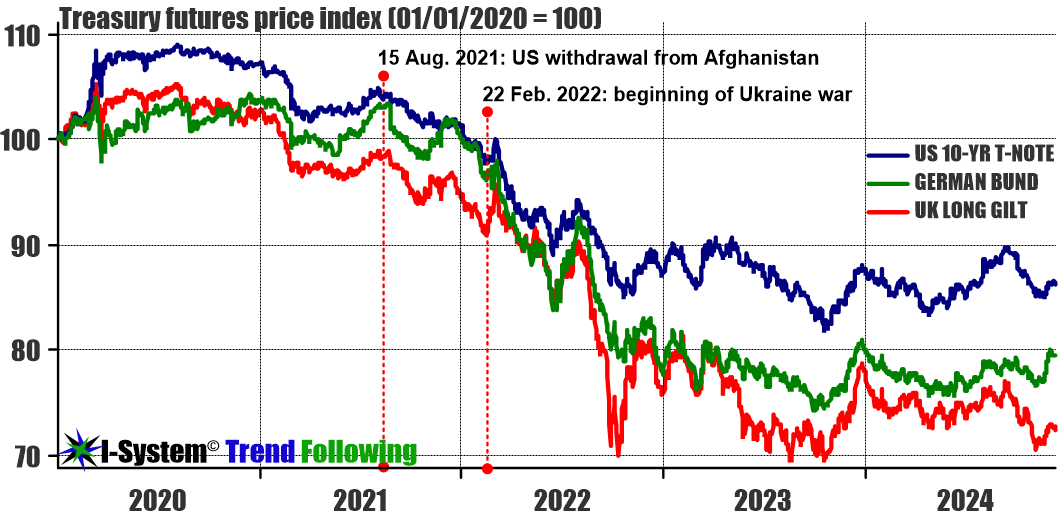

Since my August article, I wondered if I wasn’t wrong to single out the UK as the most exposed economy and the one that’ll crash the hardest. I checked the capital markets’ verdict on the situation by comparing the recent performance of British, German and American bonds. Sure enough, so far the markets appear to agree:

Over the last four years, British government’s debt has performed the worst of three. Germany’s debt has done marginally better and the US debt, as could be expected, has been the least affected. Over the coming months and years, Britain might be the first among the G7 economies to capsize and plunge into a deep crisis of stagflation and ultimately hyperinflation.

If that is so, how can we navigate the coming changes advantageously? Making a broad brush prediction is one thing – navigating it successfully is far less straightforward and it requires some foresight, skill, and a method.

What happens next?

The unravelling of this crisis will be for history books. Former Fed chairman Arthur Burns said that “A subtle understanding of economic change comes from a knowledge of history and large affairs, not from statistics or their processing alone.” Indeed, it was just this understanding of history and large affairs that’s led me to make a prediction about Britain’s descent already three years ago. In an article I published on 11 October 2021 I wrote as follows:

“The UK will likely make all the mistakes made by other powers in that similar position through history: it will suffocate its domestic economic growth by imposing hard austerity at home while at the same time increasing military spending and foreign adventurism. Britain’s public debt will continue to outpace its GDP growth and the government’s budget deficits will be covered by Bank of England’s monetary inflation. This recipe reliably leads to stagflation and possibly to hyperinflation.”

This is exactly what started to unfold over the last three years. For the record, I wrote the above before the war in Ukraine even started, adding tens of billions to the debt overhang. It was before Boris Johnson preannounced the war in his cryptic speech on Monday, 15 November of that year (2021). Addressing the attending dignitaries at the City of London banquet, then Prime Minister Johnson issued a warning to the European governments:

“We hope that our friends [in Europe] may recognize that a choice is shortly coming between mainlining ever more Russian hydrocarbons in giant new pipelines and sticking up for Ukraine and championing the cause of peace and stability.”

How Johnson knew that this choice was shortly coming remains a mystery, but the fact that he did know it and that he included that announcement in his remarks was very significant.

The statement was a big reveal: it suggested that Britain took the leading role in Project Ukraine and gambled heavily on it. That gamble went badly wrong and the bills are now coming due. That is what induced the panic in the British establishment’s ranks. Incidentally, Johnson’s statement is also the lead to the main suspects in Europe’s escalating energy wars.

Project Ukraine accelerated Britain’s decline, but that decline has already been long in the making. In my 2021 article, which was titled, “The fall of Global Britain: an investment hypothesis,” I made the following specific prediction:

“… at a macro level, we can expect the following developments over the coming months and years: asset prices will probably continue to rise (i.e. a bullish cycle for the FTSE 100), but the government bonds will continue to slide along with the British pound.”

Here’s how these predictions panned out thus far:

Broadly, my prediction was correct, but the price changes didn’t exactly follow straight line trajectories. This is normal; markets don’t do what we think they should do from the moment we become aware of some fact. They are driven by the collective psychology of their human participants and large-scale price events only begin to unfold when a critical mass of them adopt a certain view. This is why large scale price events are unpredictable and the challenge of navigating them profitably is not trivial. One thing we do know for sure is that large-scale price events unfold as trends that can span weeks, months or even years.

How to navigate the fallout? Just follow trends!

While nobody can predict the timing or magnitude of these events, one thing we know is that large-scale price events (LSPEs) invariably unfold as trends and these can span many months and even years. Indeed, in “The Art of War,” written more than 2,000 years ago, Sun Tzu said that there are three great avenues of opportunity: events, trends and conditions.

In the current British crisis, we seem to have all three of these avenues converging: the financial and economic conditions are causing events which will trigger great trends, which could be for future history books. Here’s how German imperial bund fared through the dying days of the Weimar Republic:

Of course, such events are only obvious in hindsight. How to navigate them in real time is far from obvious. The most reliable way to do so is by relying on quality trend following strategies. Trend following cuts through the information overload straight to the final product of financial analysis: crystal clear, actionable decisions that will keep you on the right side of important trends in any market.

Our navigation aide…

That is precisely the kind of decision support we offer through our daily I-System TrendCompass reports. They’re based on time-tested algorithms that my team and I developed 25 years ago and have used daily ever since. They helped us generate a stellar track record in live trading and today these same algorithms are generating the signals you can receive daily through TrendCompass reports.

The signals will tell you when to go long, when to go short, when to cut your losses and when to take profits in any market. In over two decades, we have never once failed to capture windfalls from significant trends, in bull and bear markets. Recently, we launched a TrendCompass report on Substack covering 16 key global markets which include the British pound, British gilt and FTSE 100 stock index (it’s priced at less than $1/day for top notch trend following signals).

Thank you for reading! I wish you much health, happiness, prosperity and peace in 2025 and beyond

As 2024 is drawing to a close, I wish you an excellent start in the new year with prayers for good health, happiness, prosperity and peace. Perhaps 2025 will see a great transformation begin to unfold in Britain, with the collapse of the old imperial establishment.

If so, good riddance, it could be a good thing, and better still if we can profit from its collapse and set off into the new new normal intact and capable of contributing to the building of a better system, more conducive to people's happiness and prosperity.

Notes:

[1] Thanks to the 2010 Dodd-Frank Act, the Fed is exempt from Freedom of Information Act

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass investor reports which cover over 200 financial and commodities markets. One-month test drive is always free of charge, no jumping through hoops to cancel. To start your trial subscription, drop us an email at TrendCompass@ISystem-TF.com - or check out TrendCompass on Substack!

For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. Further information is at link.