The one force moving stocks and where it's pushing the markets next

A full century of empirical data shows that stock markets are about to collapse

There is one force moving stock prices that’s seldom discussed, but which trumps all other factors market analysts study: the money supply. Back in the 1990s I was one of the genius stock investors: only in my 20s, I was raking in profits hand over fist, far outperforming all the 'old hands' who sat on the sidelines, complaining about stratospheric stock valuations, the crowd’s "irrational exuberance," and predicting an imminent crash. Those predictions started as early as 1996, the time when Nasdaq still had another 200% higher to go and another 4 years of barely interrupted bull run. Clearly, experience was overrated.

But while it was gratifying to feel like a genius and make huge profits, I had the gnawing suspicion that there was some great force pushing that created the whole market tide. The first time I encountered an explicit formulation that there was such a force was in a 2006 HedgeWeek interview with Bill Browder, the CEO of Moscow-based Hermitage Capital Management fund: "... Hermitage has identified a 90% correlation between money supply growth and the Russian RTS equities index from 2003 and 2005. Increases in money supply are highly correlated with an increase in equity values…"

More recently, Stanley Druckenmiller corroborated the idea: "Earnings don't move the overall market, it's the Federal Reserve Board... focus on the central banks and focus on the movement of liquidity... most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets."

The empirical evidence

In his masterful 1974 book, Dying of Money, Jens O. Parsson offered empirical evidence supporting this hypothesis:

“Monetary inflation invariably makes itself felt first in capital markets, most conspicuously as a stock market boom. … This happened at the commencement of the German inflationary boom of 1920, and it happened again at the commencement of the American inflationary boom from 1962 to 1966. Indeed, every monetary expansion in the United States since World War II was followed by a stock market rise, every cessation of monetary expansion by a stock market fall. Conversely, every stock market rise was preceded and accompanied by money inflation. Bull markets rest on nothing but inflation.”

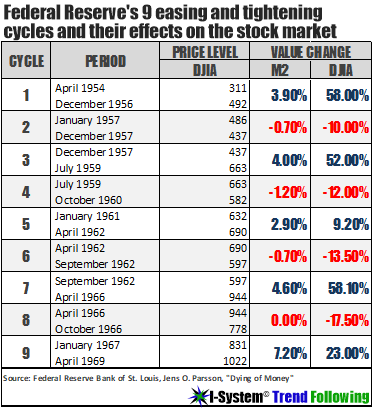

Parsson outlined ten such monetary easing and tightening cycles which almost perfectly coincide with great rallies and corrections in the stock market:

But what’s interesting here is not just the absolute expansion of money supply. If money supply contracts at all, it may lead to a stock market collapse. This was shown during the Nixon years. By 1969, monetary inflation expanded to almost 8% per year, the fastest rate since 1946. Then in May 1969 Federal Reserve began to tighten, reducing the money supply growth to 3.8%. Although this was still a relatively high rate of inflation, within two months, average stock prices dropped by 14% and within another year they were off by 31%!

The same principle was at work during and immediately after the roaring 20s (1930 through 1933). According to Murray Rothbard, “M” money supply was growing at an 8.1% annual clip from mid-1921 through 1928 fuelling a nearly 25% annual inflation of stock prices (Joseph T. Salerno offered an instructive discussion of this period in "Money and Gold in the 1920s and 1930s: an Austrian View.") The bull market that started in 2009 was no different: in 2016, Brian Bariner of ValueBridge Advisors attributed 93% of the 2009-2016 stock market rise to the Fed's QE program.

Indeed, as Parsons wrote, “The stock market dances to an inaudible tune that is played for it by the government’s money inflation or deflation … A man who fully understood what inflation was doing at all times would seldom be surprised by the stock market. Armed with that understanding and little else, he could participate profitably in every stock market rise, step aside safely from every stock market fall, and shepherd his property with reasonable security through the bombardment of inflation or deflation. … When the government first turns on money inflation in times of slack business, the money has no work to do yet and nowhere to go but into investment markets. So the markets rise, even though business is still bad. … A rising stock market signals nothing but freshening money inflation. It is the earliest and most sensitive indicator of the inflationary train of events to come.”

M2 is shrinking - are we in for a major bear market?

In view of all this, U.S. stock markets might be in for a brutal correction, since the Fed has turned the M2 money supply growth negative (-5% annualized rate!) for the first time in 90 years:

The last time Federal Reserve actually reduced the money supply, the stock market collapsed and it took a very long time for it to recover:

Do we have a prediction? The relationship between money supply and the stock markets should make a strong case that we are at the verge of a major correction or even a bear market the likes of which we haven’t seen in a very long time. This prediction aligns with Jeremy Grantham’s “presidential cycle” hypothesis, which I outlined in last week’s article, “Stock market: is a 50% decline imminent?”

Making predictions is hard, especially about the future

However, making predictions is an extremely thankless task even if the case may seem compelling. To begin with, I am not entirely certain whether the Fed has other tricks up their sleeve, selectively providing liquidity to certain banks and certain corporations who are once more using that liquidity for more stock buybacks. Keep in mind also that there are almost $32 trillion in liquid USD-denominated assets held by foreigners outside the United States; an accelerated repatriation of those balances would almost certainly flood into the stock markets, providing very substantial liquidity and creating an upward pressure on prices.

It would be impossible to forecast the effect of all these elements on the stock markets. By contrast, it is very likely that we'll experience great volatility and very significant changes in the markets over the coming months. Their timing and direction may be unpredictable, but systematic trend following strategies will help investors keep the correct directional exposure to these trends so hey can profit regardless of whether the developments turn out to be bullish or bearish. If you don’t have access to high quality trend following strategies, consider signing up for the daily I-System TrendCompass newsletter. The first month’s test drive is always free of charge.

Alex Krainer – @NakedHedgie is the creator of I-System Trend Following and publisher of daily TrendCompass reports which cover over 200 financial and commodities markets. For US investors, we propose a trend-driven inflation/recession resilient portfolio covering a basket of 30+ financial and commodities markets. For more information, you can drop me a comment or an email to xela.reniark@gmail.com

"If wishes were horses...then beggars would ride" Prepping for collapse...no one...throws a switch...we have all been witnessing this in slow motion...for many years now. Unfortunately...the "beggar index" is in an inflationary cycle. Global migration due to war and economic hardship...drug induced poverty...mental illness...and homelessness...are on the rise. The financialization of our existence appears to be the financial criminals latest "smash and grab" extortion scheme. Someone I follow recently quoted David Attenborough's metaphor of ants in a jar..."Place two types of ants in a jar...red ants and black ants...they co-inhabit the jar peacefully. If you shake the jar...they violently attack each other". The societal/civilizational costs are incalculable...and beyond the imagination. Not to be completely deterministic...but there is a strong sense that our jar is being purposefully shaken. Thank you always Alex!

Ouch. (a great analysis, though)